RBA interest rate

The aim of this policy is to achieve low and stable. Interest rate benchmarks are widely relied upon in global financial markets.

No Plans To Hike Interest Rates In 2022 Says Rba

The Reserve Bank lifts interest rates for the fifth month in a row taking the cash rate to 235 per cent a seven-year high.

. RESERVE BANK OF AUSTRALIA INTEREST RATE EXPECTATIONS OCTOBER 13. A media release is issued at 230 pm after each Reserve Bank Board meeting with any change in the cash rate target taking effect the following day. The board increased the interest rate on Exchange Settlement balances by 25bps to 275.

The central bank is widely expected to raise the Official Cash Rate OCR by 50 bps. The RBA cash rate affects the interest rate banks charge their customers as well as the rates of interest paid on savings accounts and term deposits. Interest Rate in Australia averaged 385 percent from 1990 until 2022 reaching an all time high of 1750 percent in January of 1990.

They are referenced in contracts for derivatives loans and securities. More tightening may be ahead but it may come in more measured increments over the next few months. The RBA is expected to announce a fifth consecutive 05 per cent rise - and sixth consecutive hike since May 2022 - at its meeting today taking the cash rate to 285 per cent.

A Includes loans at variable and fixed interest rates Sources. Current RBA cash rate. Stay on top of the RBAs monthly cash rate decisions with predictions and insights from 40 experts.

Despite this markets have priced in another. Despite this markets have priced in another. Although analysts expect the RBA to halt its policy tightening path at a cash rate of 35 financial markets currently price the central bank to continue hiking until it reaches a peak rate of 39 next year.

Its the RBAs most aggressive series of rate rises since 1994 when the cash rate went from 475 to 75 per cent in the space of. The RBA also publishes a cash rate total return index TRI since May 2016 as a complementary backward-looking benchmark based on the cash rate. The Reserve Bank of Australia is under pressure to end its interest rate hikes at todays meeting amid fears the economy could go into a recession.

If the RBA raises the cash rate by 25 bps from 260 to 285 and lenders pass that on in full then the average variable home loan interest rate would be 541. Reserve Bank of Australia The Reserve Bank of Australia RBA is the Australian central bank. Look back on Tuesdays developments.

Prior to December 2007 media releases were issued only when the cash rate target was changed. RBA cash rate Are interest rates going up or down. The current Australian interest rate RBA base rate is 2600.

RBA Assistant Governor for Economics Luci Ellis remarks this week effectively pegged the neutral rate between 25 and 35. Currently the RBAs main rate is 26. For further information about the cash rate.

Taking the annual rate up to 54 per cent. The Westpac Life total variable rate with bonus interest has increased by 050 per annum to 235 per cent while the Westpac Bump Savings total variable rate with bonus interest has also risen to. Cash Rate Target.

A Look at the Markets. The RBAs key interest rate is now at its highest in more than seven years. The cash rate is Australias official interest rate which is currently held at a target of 26 by the Reserve Bank of Australia RBA.

RBA average owner-occupier variable rate for existing customers April 2022. The RBA has raised interest rates for five months in a row now. Graph Australian interest rate RBA - long-term graph.

At the time the cash rate target was 01 per cent and it is now 235 per cent and Mr Lowe plans to raise the rate even more in coming months. The Reserve Bank of Australia is under pressure to end its interest rate hikes at todays meeting amid fears the economy could go into a recession. The RBA has been lifting interest rates to slow inflation which at a monthly level has reached its fastest pace since the 1990-91 recession.

Philip Lowe the RBA governor said the central bank remained committed to returning inflation to the 23 range. The Reserve Bank of Australia RBA is set to announce the fifth straight rate hike this Tuesday at 0430 GMT. Eleven times a year the Reserve Bank of Australia RBA meets to decide whether the cash rate should go up down or remain the same a decision which affects millions of Australians.

Based on a 25-year 500k home loan comparing repayments with RBA average rate in April of 286 versus a 375 basis point increase from continuous cash rate hikes to Westpacs predicted peak of 385 in March 2023. Monetary policy decisions involve setting a target for the cash rate. Australia Interest Rate History.

The RBAs most important task is to set the monetary policy for Australia. RBA For more details see Statistical Table F6 Housing Lending Rates and Statistical Table F7 Business Lending Rates. Prices went up 25 per cent over the past two years.

The cash rate is determined by the Reserve Bank of Australia in a board meeting every month excluding January. The Reserve Bank of Australia has hiked interest rates for the sixth month in a row but by only half the size of the previous five raises lifting the cash rate by 25 basis points to 26 per cent. If the RBA raised the cash rate by 50 bps to 310 and that was passed on in full the average variable home loan interest rate would be 566.

The RBA has now lifted its benchmark interest rate by 175 percentage points since its first rate rise in May with the cash rate target sitting at 185 per cent. The Reserve Bank of Australias RBA rapid fire monetary tightening is unprecedented unleashing 225 per cent worth of interest rate hikes over five consecutive board meetings.

Mae Nvsds6aztm

Rba Final Cash Rate Call For This Financial Year Nevile Co Lawyers

Rba Cash Rate Forecast From 40 Experts November 2022 Finder

Rba Rate Update Rate Cut Decision Forecast Updates

Interest Rates Are Going Up Again And Again And Again The Latch

Why The Rba Will Cut Mortgage Interest Rates In 2022 Macrobusiness

Rba Interest Rates Reserve Bank Raises Official Rate To 2 35 Amid Inflation Fears Interest Rates The Guardian

Rba Interest Rate Announcement Australia S Interest Rates Slashed To History Making 0 10 Per Cent

Rba Announces August Interest Rate Rise To 1 85 What This Means For Off The Plan Property

Rba Lifts Cash Rate For First Time In 11 Years Money Magazine

The Rba Rate Cut Smartline

I1ruhkw97lyckm

Mitrade Today S Major Event Rba Interest Rate Decision Background Reserve Bank Of Australia Rba Board Members Come To A Consensus On Where To Set The Rate Previously In Australia

Rba Cuts Interest Rates To Record Low

Rba Interest Rate Preview Don T Write Off A 50 Bps Rate Hike

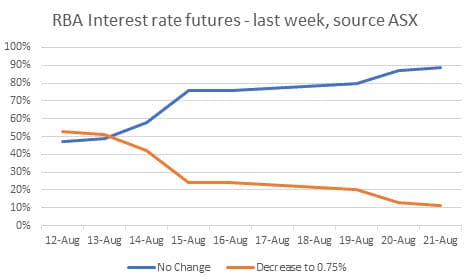

Central Bank Watch Boc Rba Rbnz Interest Rate Expectations Update

How High Will The Rba Hike Interest Rates Macrobusiness